Yogyakarta, September 12th 2021─GAMAPI and KAPSTRA Fisipol UGM held an Acitya Webinar with the title “Stock Strategy for Beginners in a Pandemic Period” on (12/09). This event is held online and is a collaboration between GAMAPI’s entrepreneurship division and KAPSTRA’s creative economy. On this occasion, the presenters were quite interesting, namely Fischa Dwi Choirina as the Capital Market Educator for understanding stocks. In addition, this event was moderated by Bhram Raditya K. as the Deputy Chair of ESM FEB UGM and was attended by 240 webinar participants. In general, the discussion in the webinar explores various information about investing and stocks, ranging from the importance of having an investment mindset to safe investing tips for beginners.

Starting the webinar, the remarks were delivered by the Chairperson of GAMAPI and KAPSTRA Fisipol UGM. On this occasion, the two chairmen said that the collaboration was a form of organizational productivity even though they were in a pandemic. This event is expected to provide useful knowledge and information for the discussion participants.

Next, the webinar moderator delivered an intermezzo to animate the discussion. In his speech, he said that currently the number of investors in Indonesia has grown to more than 100 percent. Therefore, stocks become one of the promising investment alternatives. This event can provide positive insights regarding the risks and benefits of investing in the stock market.

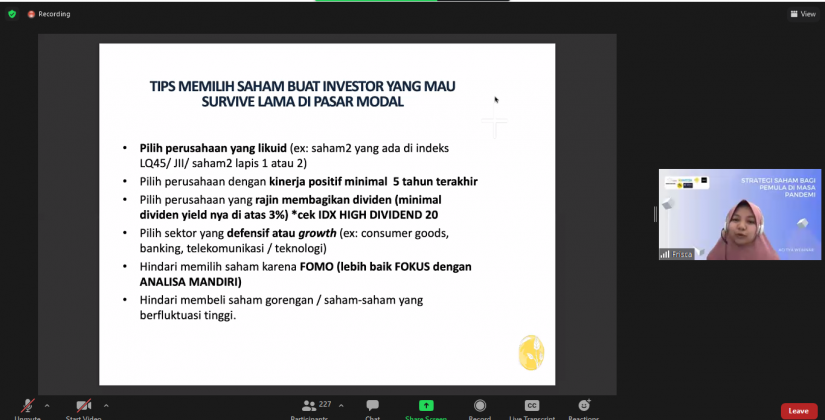

Continuing what was said by the moderator, the speaker agreed that the millennial generation must keep up with the times, including investing. In this case, the mindset that must be built is not to become suddenly rich, but to be financially independent in the future. Therefore, there is no instant way, but it requires knowledge and consistency from a novice investor. Currently, the capital market is an investment space that is pocket-friendly and has legal guarantees. However, when deciding to invest we need to make sure that the shares we buy come from companies with good enough sustainability. Starting an investment is not without risk, therefore we need to cover up existing fears by continuing to learn so that the knowledge we have is also capable enough to prevent bad things that might happen.