Yogyakarta, 9th of October 2024—The 7th day of Digital Society Week event discussed the intersection of education, the education system, and digital technology. This discussion was opened with a discussion session regarding the rampant use of online loans (pinjol), which is currently used as a ‘solution’ to the problem of increasing tuition fees. This discussion session was led by Hilman Nuraman and reviewed by two speakers, namely Arifatus Sholekhah (Researcher at CfDS) and Achmed Faiz (Researcher at CfDS).

The discussion regarding results of the research on tuition fees and online loans in campuses was prompted by online debates on one of the state university menfess accounts on social media X. This research revealed that there is a whole pinjol industry that explicitly disclose that they can access payment for tuition fees. Results of sentiment analysis showed that 54,9% of people on the net either criticized or gave negative responses on the discourse of tuition fee payment policy through pinjol.

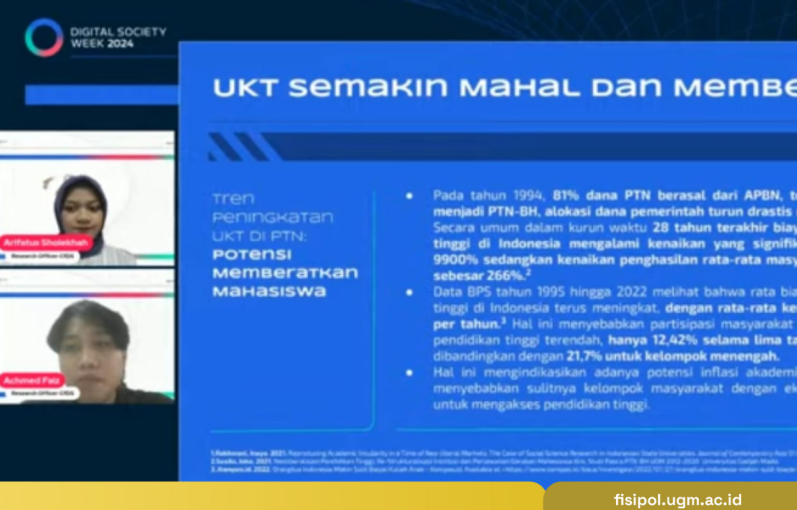

The discussion was not just about online loans nor tuition fees, but also the issue of rising cost of education, which significantly hindered inclusive access to education. Tuition fee payment policies in several Legal-Entity State Universities, specifically in UGM and ITB, implemented internal and even interest-free installment schemes. Installment schemes proposed by online loans are much higher in terms of interest, which is even more burdensome for students, especially those in vulnerable economic groups..

Not only that, this discussion also revealed very interesting findings on the implementation of the student loans system in Indonesia. The implementation of the student loan scheme in Indonesia was shown to have been extremely dependent on the private sector. These private sector groups often work with fintech-based corporations. This problem is also getting worse because there is the lack of legal protection for the debtors in the fintech-based pinjol system. In the long run, if the debtor fails to pay up the fees, they will be pursued by debt-collectors, and this can eventually lead to students dropping out from college.

From many sessions of problem-mapping of the student loan scheme in the campus area, CfDS pays attention to several things. “Findings of this research can be a form of support from CfDS for students to critically think about student loan schemes in Indonesia. Lastly, this effort involves the role of student advocacy. They can, for example, strike about the issue of the rising cost of education and the widespread use of pinjol schemes.