Yogyakarta, June 4th 2021━Social Entrepreneurship of UGM together with Finansialku.com held a class entitled “Why is it Difficult for the Sandwich Generation to Buy property?” on Friday (4/6). The speaker at this event was Shierly, S.E., MBA., CFP, as the Financial Planner of Finansialku. The event took place on the YouTube channel of Finansialku.com at 02.00 p.m. to 03.30 p.m.

Sandwich generation is a generation of adults who are squeezed and have to bear the financial burden of a generation of parents and children (Dorothy Miller, 1981). The term sandwich generation is used to refer to the people who not only bear their own lives, but also bear the life of the generations below them and or above them.

Based on the results of the 2020 population census, Indonesia’s population reached 270.20 million people. From this figure, 64.69% of the younger generation, 47.75% of the workforce, and 52.25% of the non-working force are counted. Meanwhile, the percentage of elderly people is 9.78% with a ratio of 1 in 2 elderly still working, of which 85.83% of the elderly work in the informal sector. In addition, the largest source of household financing, according to BPS 2020, is 78.27% of working household members.

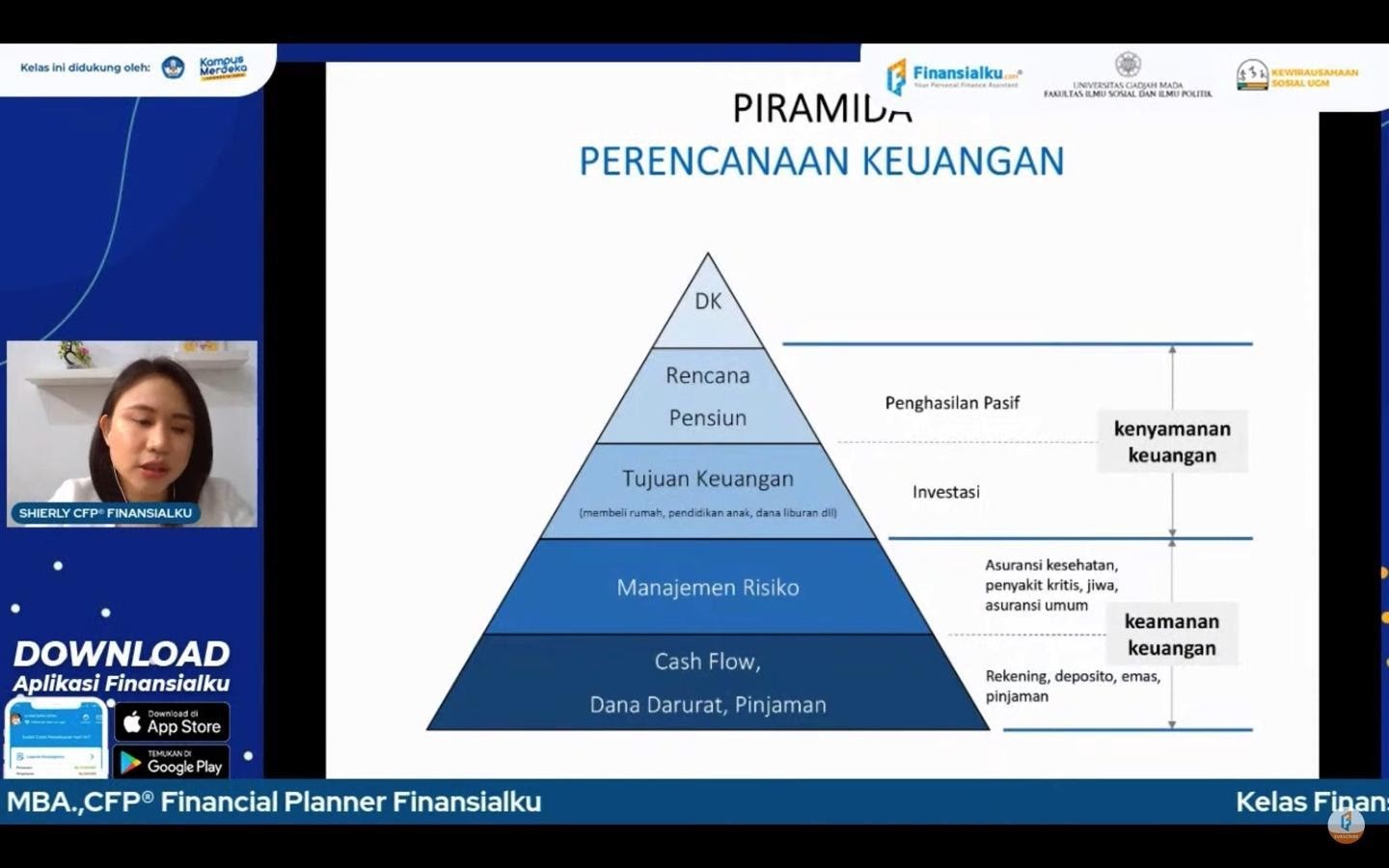

Shierly explained, there are several causes of the sandwich generation. These include: low financial literacy; do not have a mature financial plan; lacking in preparing pension funds; do not have risk management (e.g.: health protection); and high maintenance lifestyle.

“Actually we are able to make financial plans, we don’t need to be 100% perfectionists, because we can continue to improve our plans step by step, but of course, if we spend money without planning it will lead us to consumptive behavior, spending money carelessly, and not enjoying our lives” Shierly said.

Early financial planning is very important for future needs. In connection with the reason that the younger generation or the sandwich generation find it difficult to buy property, this is driven by the high level of funds to buy property, a consumptive lifestyle, and not investing to prepare funds to buy property. This causes us to be less able to estimate short-term and long-term funds.

“We need to maintain a lifestyle so that when our income increases, the lifestyle does not increase, but continues to increase the investment allocation,” Shierly said.

In this case, what needs to be considered before buying property is related to financial planning, namely the current financial condition, and how to achieve financial goals. Therefore, young age is the right time to increase income, ensure safe cash flow, set financial goals, start investing, and build a good reputation.