Yogyakarta, November 19th 2021─Social Entrepreneurship of UGM together with Kelas Finansialku held a webinar entitled “Planning Retirement from a Young Age” on Friday (19/11). The event, which took place via the YouTube Live of Finansialku.com, featured Gembong Suwito as speaker, the Financial Planner of Finansialku.

At the beginning of the presentation, Gembong delivered material about the importance of retirement planning. Based on data, as many as 9 out of 10 Indonesians are not ready to face retirement and 65% of Indonesians live in poverty in retirement. In addition, the life expectancy of men is shorter than women.

“Based on the Central Bureau of Statistics as of May 13th, 2021, the average life expectancy of men is 69 years, while women are 73 years,” Gembong said.

Related to these data, there are several common mistakes that cause an unhappy retirement. Among them is not counting at a young age, whether to plan for retirement or not because it is still a long time. Then, someone tends to rely on the office for pension funds and old-age benefits, which alone are not enough.

Another mistake is not investing, most people just save. Investment or saving is also not started early. In fact, what is more fatal is if someone has long-term debt such as KPR (House Ownership Credit) and KTA (Unsecured Loans).

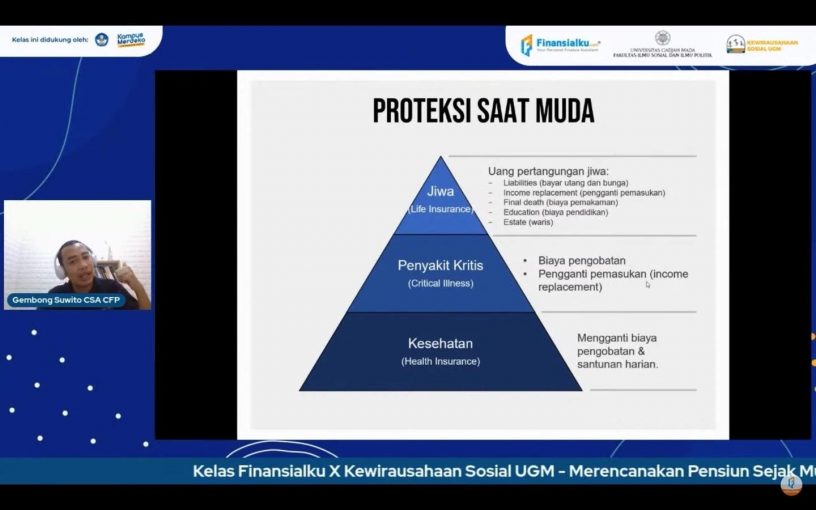

When planning for retirement, we must manage finances that come from active income (earned money), investment income (stocks, bonds, peer to peer, deposits), and passive income (such as rent). The next step is to protect at retirement by having life insurance, critical illness, and health.

“At least we have protection when we retire because in experience, the biggest cost is health costs, we are safe if we already have protection, at least it doesn’t bother others or our family,” Gembong said.

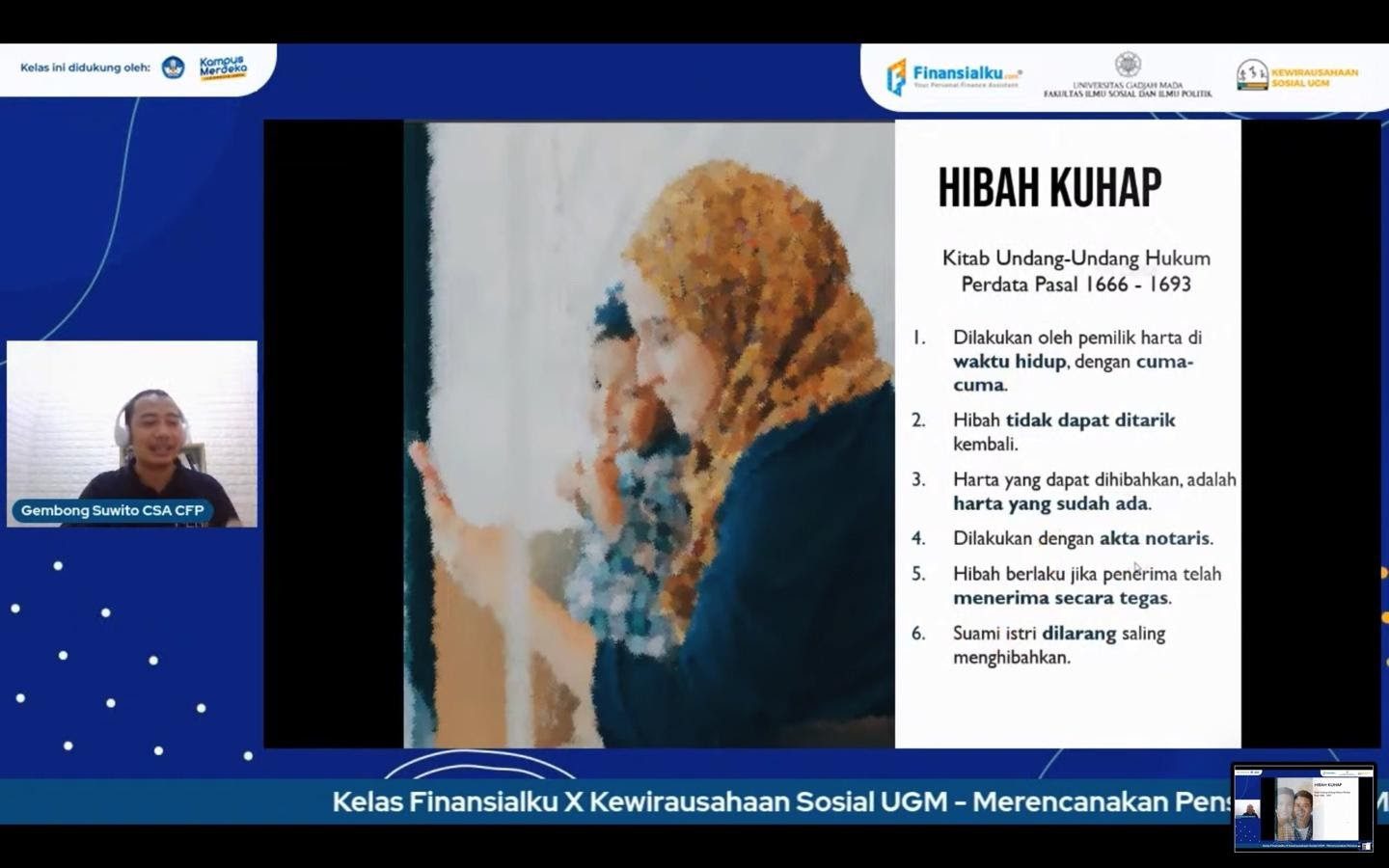

Furthermore, Gembong also explained about the distribution of wealth. How is the process of transferring wealth from the owner to the expected person, in conditions before or after the owner dies. The transfer of wealth when the owner is still alive is called a grant, while if the owner is dead it is called an inheritance.

For information, parents may transfer their wealth to their children as long as they are still alive, which is regulated by the Civil Code. With the following conditions: it is done free of charge, cannot be withdrawn, the property that is donated is an existing property, it is carried out by notarial deed, the recipient can accept it expressly, and husband and wife are prohibited from giving wealth to each other.