Yogyakarta, June 5th 2023 – For some people, owning a house is a difficult thing. The economic condition shows that the growth of the property sector continues, while the younger generation, specifically millennials, is stuck with fluctuating income and economic uncertainties. The research results from Unitrend in the Department of Public Policy Management (DMKP) FISIPOL UGM showed how millennials perceive the property industry through a press release of the National Survey Result titled “Building An Inclusive and Sustainable Future of Property” through a Zoom Meeting on Tuesday (05/06). The press release invited several speakers: Ignatius Ardhana Reswara, S.IP (Manager of UniTrend), Asta Ivo BS. Meliala (Project Director of Perum Perumnas), Dr. Erda Rindrasih (Lecturer in the Department of Public Policy Management), Ratna Indriyani (General Director of Infrastructure and Housing Funding PUPR).

“The young generation is now grappling with an income that can’t compete with the price of the property,” said Ignatius Ardha, the Manager of Unitrend.

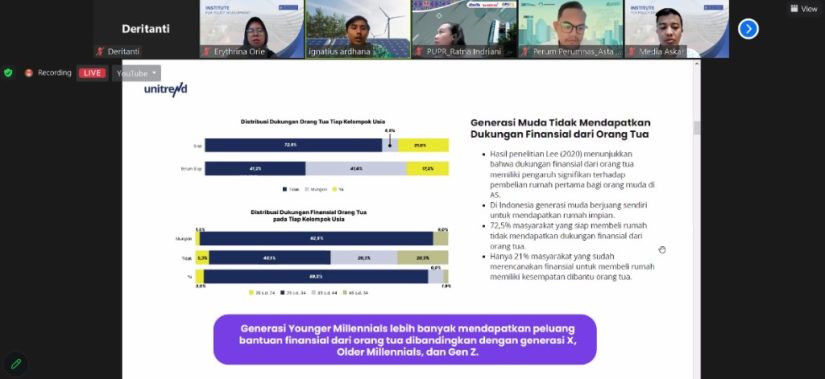

Based on the research data with more than 1000 respondents across Indonesia, the majority of the young generation does not have financial support from their parents to get their first house. “Meanwhile, in America, parents’ financial support significantly impacts the USA’s young generation’s first house purchase,” Ardha said.

Other than the lack of financial support from their parents, another challenge that this generation is facing in buying a house is an unstable income, lack of savings, and lack of a stable job. The research also shows that people with low education tend to pay cash to buy their house and they do not have financial readiness just yet. Meanwhile, those who have a higher education tend to choose an alternative purchasing method such as credit and they already have financial readiness.

Asta Ivo, the Project Director of Perum Perumnas, added that the image that buying a house is a primary need for millennials has been exchanged for other secondary and tertiary needs such as purchasing a car, communication devices, as well as other things to relax and refresh themselves.

“There are secondary needs that are now categorized as primary needs, so this is the main obstacle for millennials who want to have a house,” Ivo said.

As a developer that gives input, insight, and housing for the society, Perum Perumnas has the initiative to create housing with three main points: revitalization, transit-oriented development, and the precast method..”

Erda Rindrasih, a DMKP lecturer, explained that the urban sprawl phenomenon is a big issue in the property sector. This phenomenon is related to the spatial development of cities that are big, massive, and wide, pushed by population growth, income growth, as well as how cheap traveling is. “The urban sprawl impacts several things such as the marginalized groups, environment and health quality, mental health, as well as market failure.”

To overcome issues such as income inequality and the urban sprawl phenomenon, the government can intervene by giving better access to funding for their citizens. “There needs to be a more creative socialization on the alternative or strategy of funding and the ease of access to consultation regarding funding or financial planning literacy,” Ardha added.