Yogyakarta, April 5th 2024─The Center for Digital Society (CfDS) Response discusses the phenomenon of the increase in students’ tuition fees (UKT) at various public and private universities and the emergence of the phenomenon of online student loans (pinjol) as an option for some students to pay UKT through CfDS Live Youtube on Friday (05/04). The discussion showed data from the CfDS team’s research that examined tweets through viral social media X about the increasing of UKT and pinjol which began on January 25, 2024 from the menfess account @itbfess. The tweet showed an online loan service brochure for UKT payments which received responses from various parties.

“There was a trend of pinjol and UKT tweets from January 25, 2024 and increased again on February 4, 2024 along with UKT payments at several public universities in Indonesia,” explained Achmed Faiz, CfDS Research Officer.

Based on the research results with the keywords UKT and pinjol, the distribution of sentiment shows that most of the negative sentiment is in the form of criticism and negative responses to the UKT policy through pinjol. According to Achmed, the problem found is that UKT is getting more expensive and burdensome, which is not balanced with the increase in the average income of Indonesian people. Data from Kompas states that in the last 28 years, the cost of higher education in Indonesia has increased significantly, reaching 9900%, while the increase in the average income of the community is only 266%.

“This has the potential to create academic inflation, which makes it difficult for economically vulnerable people to access higher education,” Achmed explained.

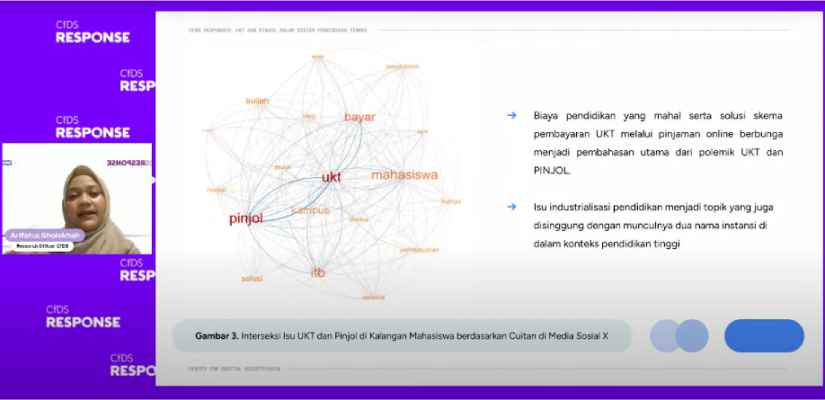

Meanwhile, Arifatus Sholekhah, Research Officer of CfDS added that the ironic reality related to online loans is the administration scheme and interest on UKT installments that burden students. Through network analysis of X social media conducted at sample universities, namely UGM, ITB and UI, it shows that the cost of education offered is expensive and the solution to the UKT payment scheme through interest-bearing loans is the main discussion of the UKT and loan polemic.

The CfDS research team firmly rejects the collaboration of universities with lenders who use high interest rates and burdensome schemes. “We strongly reject it, because it is burdensome and does not provide the right solution for students,” explained Arifatus.

The CfDS research team underlines that universities have a vital role in UKT policy regarding the determination of the UKT amount and the solutions that can be offered. If it continues, the next impact will be the industrialization of education which causes the potential for UKT to be more expensive and results in a decrease in access to education and social inequality in the long run.

“Through the results of this research, we encourage the critical attitude of the academic community and increase the role of student advocacy tools so that they can voice at higher forums for more appropriate solutions for all parties,” said Arifatus. The purpose of this research is in line with efforts to encourage the 4th SDGs point, namely Quality Education.