Yogyakarta, 8 October 2024─The digital economy has grown so significantly that it has changed how people interact, work and conduct business. Digital technology has become the main driver in accelerating economic growth and opening up the potential to answer the needs of society. Through the 6th day of Digital Society Week, the Center for Digital Society explored the issue in two discussion sessions that raised the topic of financial inclusion in the digital era.

Community involvement is one of the most important considerations in economic growth. Financial inclusion means prioritizing community involvement in the development of financial technology. In this case, the biggest contribution is made through Super Apps, which provide easy access to various financial services.

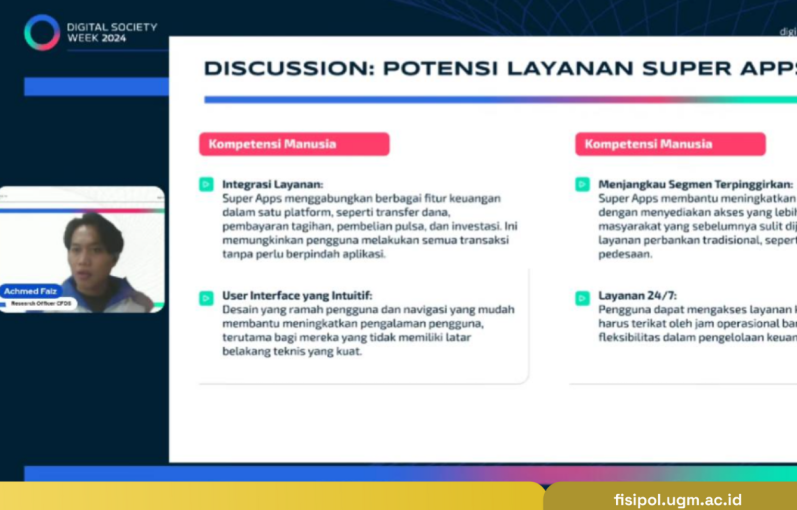

Achmed Faiz Yudha Siregar, a Researcher from CfDS, in the first session entitled “Super App Banking, Financial Inclusion and Community Welfare,” explained that Super Apps can now answer the community’s need for access to financial services that were previously not served by the traditional banking system. However, the existence of super apps still faces challenges, especially in terms of human competence.

“Service integration, intuitive user interface, continuing to reach marginalized segments, and 24/7 services are aspects of ideal conditions as well as challenges (related to human competence) because it is not easy with the current conditions to integrate services,” Achmed explained in his presentation.

By providing wider access to technology, people can engage in the digital economy, access larger markets, and improve their lives. In addition, inclusive economic measures in the current digital era are often dominated by BNPL (buy now, pay later) services.

According to Emira Anjani, Research Assistant at CfDS, such credit-based services can support financial inclusion and the universal availability and access to financial products and services for all individuals.

“The selling point of BNPL is the principle of providing safer and lower-cost credit for consumers. From a broader perspective, BNPL supports financial inclusion, especially for the unbanked,” Emira Anjani said in her presentation.

Through the second session entitled “Buy Now, Pay Later: From Financial Inclusion to Financial Trap”, Emira emphasized that the easy access to credit from BNPL services is vulnerable to data security due to the permeability in applying a minimal check and verification process compared to conventional bank credit. This puts users at risk of identity theft, data leakage, fraud, and data hacking. Ultimately, BNPL is only a financial tool users use by user autonomy, which must be managed with good digital literacy and responsibility.

Thus, Digital Society Week 2024 CfDS Fisipol UGM is intended not only as a forum for discussing technological developments but also to help the community understand the importance of digital literacy in facing the digital economy.