Yogyakarta, October 27th 2021─The Career Development Center of Fisipol UGM held a financial literacy webinar titled “The Financial Lives of Millennials” on Wednesday (27/10). The event was held through the Zoom meeting and invited Rezki Wulan Ramadhanty, M.Sc, the CEO of Womenpreneur Financial School, to be the speaker.

The webinar was divided into two sessions; the material sharing session and the question and answer session. In the material sharing session Rezki talked about the mindset of being financially literate and tips on managing finances for millennials. According to her, we have to have a growth mindset which means that we need to think about developing and opening ourselves up for new opportunities. Additionally, we also have to be ready to accept new challenges and learn new things that we didn’t know before.

“If there is something that didn’t go according to our plan, we shouldn’t go straight to blaming the circumstances and despairing. We need to look for the opportunities in what is happening,” Rezki said.

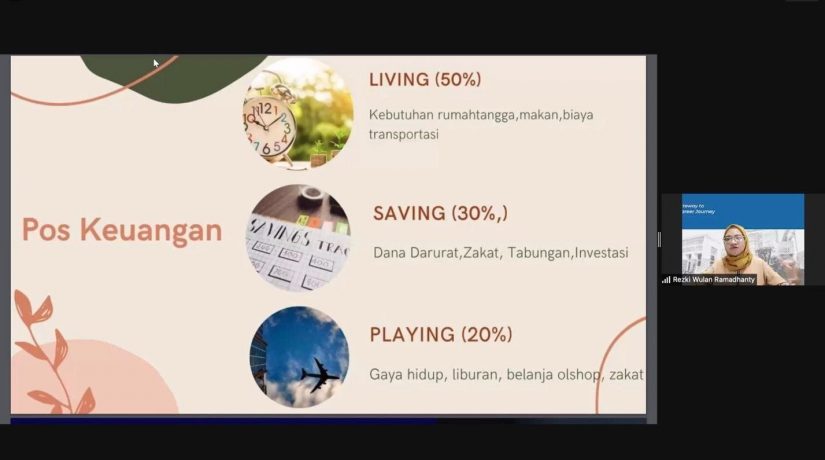

We also need to avoid a fixed mindset that traps us into old habits and therefore impedes us from trying something new. Rezki said that being financially literate is not about how much money that we earn, but how well we are able to manage it wisely. Tips on managing finances wisely are doing a check up on our financial state, knowing our financial goals, having a budget every month, knowing where to invest, and doing an evaluation. “This can be gained by dividing our finances to 50% for living expenses or basic necessities, saving 30%, and finally using 20% to play,” she said.

Meanwhile, when it comes to investments for millennials, Rezki advised that we need to diversify the form of investment such as in the form of gold, savings, and mutual funds. In this regard, stocks are not recommended for beginners because the value of stocks can go up and down out of nowhere and therefore is a very risky option if we don’t learn about it beforehand. Other than that, it is important to use one sheet of budgeting per month, one sheet of money per day, and one sheet of goals.

“The one sheet rule is the most simple rule for millennials. To do this, millennials need to budget in one sheet per month. Next, one sheet of money per day needs to be saved which can accumulate to quite a saving. One sheet of goals is also important, it is time that millennials map out what they want to do in the next one year, for example,” Rezki added.